Key Statistics from 2025

Attendees' Domains

- Final Decision Makers

- Evaluators

- Influencers

WFIS is a highly focused initiative that carefully cherry-picks key decision-making profiles from Kenya's leading financial institutions that’re actively seeking cutting-edge solutions.

Over

87%

of attendees

had influence or sole responsibility in purchase decisions

TIMELINE-BASED BIFURCATION OF DELEGATES

All delegates at WFIS 2025 - Kenya came with a pre-determined timeline for the procurement and implementation of new solutions. Here’s a quick representation.

months

months

months

WFIS Kenya

Kenya has firmly established itself as the fintech epicenter of East Africa and one of the fastest-growing hubs across the wider Middle East & Africa region. With regulators like the Capital Markets Authority (CMA) and Central Bank of Kenya (CBK) expanding and refining frameworks (including sandbox regimes, open banking policies and more agile digital finance licensing), the environment for innovation is accelerating.

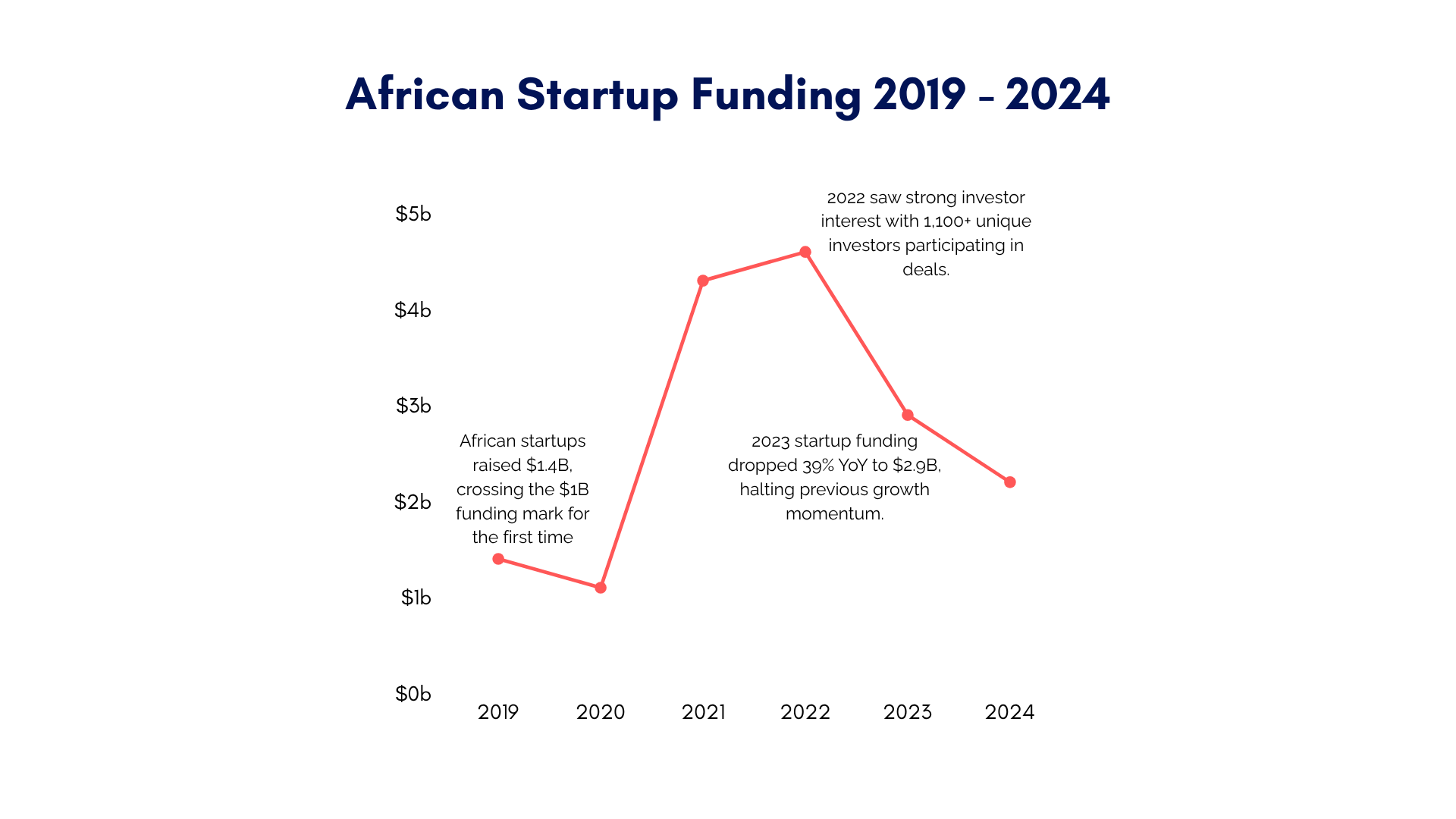

Just recently, Kenyan startups garnered $638 million in funding, the highest in Africa. Fintech firms remain front-runners, especially in payments, transfers, digital financial inclusion and embedded finance.

Simultaneously, Kenya’s mobile money market continues its trajectory of explosive growth projected to reach $727.7 billion by 2033, growing at a CAGR of 17.6% between 2025-33. On the other hand, international remittances witnessed a 12.1% jump in annual inflows to $5.08 billion by H1 2025.

To harness this momentum, Tradepass is hosting the 7th Edition of World Financial Innovation Series (WFIS) at the Edge Convention Centre, Nairobi, Kenya on 3 March 2026. The event will host over 500 technology and business heads from the leading banks, insurance companies & micro-finance institutions across the country.

CONFERENCE

Presenting the top inspiring names from the industry at the main stage to share crucial intelligence on the most pressing topics, which gets further enriched by a Q&A session.

It showcases thought leadership and cutting-edge knowledge for the growth of the entire business community. A perfect platform that projects the pulse of the industry.

EXHIBITION

Enabling the organizations to showcase their best to the many pre-qualified delegates at the event in real-time. The provision of using technology just adds on to the whole demonstration and helps in driving more leads from the top companies across the industry.

It’s specifically tailored for the organizations to get in the eyes of the region’s biggest stakeholders and uplift their overall brand image.

AWARDS & GALA

Top Talents | Competitive Categories | Exquisite Dishes | Cocktails

This session aims to acknowledge and reward the best of talents, products and organizations that are spearheading innovation and thought leadership in the industry.

But that’s not it, the session also features a scrumptious spread of hand-picked dishes coupled with a fine range of cocktails to further lift the spirits of the attendees.

AFTER-HOURS

An exclusive session for more networking exposure, allowing attendees to break the ice with some spirit-lifting humour, while enabling them to unwind and rub shoulders against industry peers, thought leaders, and potential customers.

Allowing networking interactions to happen in a more relaxed and honest way, where receiving direct feedbacks is a given phenomenon.

Digital Innovation

AI-Powered Hyper-Personalized Customer Experience

Digital Innovation

AI-Powered Hyper-Personalized Customer Experience

Banking–as–a–Service

Kenya’s Strategic Vision for Financial Innovation

Banking–as–a–Service

Kenya’s Strategic Vision for Financial Innovation

Embracing the Future

Generative AI & Data Analytics in FSI

Embracing the Future

Generative AI & Data Analytics in FSI

Leveraging the Power

Identity & Security with Biometric Innovations

Leveraging the Power

Identity & Security with Biometric Innovations

Mobile Banking

Cutting Costs & Fighting FinCrime with AI

Mobile Banking

Cutting Costs & Fighting FinCrime with AI

Big Data in Banking

Inclusive Growth via Smart Regulatory Frameworks

Big Data in Banking

Inclusive Growth via Smart Regulatory Frameworks

Retail Banking Industry

Future-Ready Finance with Cloud & Scalability

Retail Banking Industry

Future-Ready Finance with Cloud & Scalability

Digital Payments

Digital Transformation Ecosystem in FSI

Digital Payments

Digital Transformation Ecosystem in FSI